Climate Change

Engaging with external stakeholders to understand their perspectives helps inform our strategy to manage climate-related risks. We understand that market changes could result from U.S. policy, global agreements and evolving domestic and international climate change laws and regulations. At the same time, we recognize the need for reliable and responsibly produced energy and petrochemical feedstock.

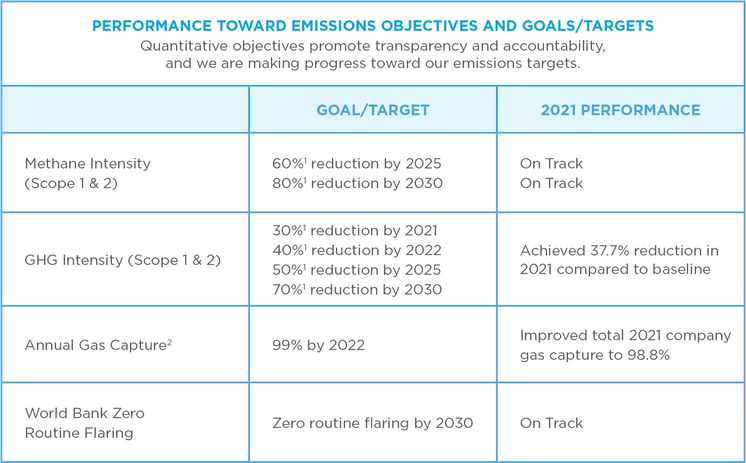

In February 2022, consistent with our objective to help successfully meet global energy demand, we set new aggressive near- (2022), medium- (2025) and long-term (2030) goals for critical environmental performance metrics, including our methane intensity, GHG intensity and annual gas capture (flaring intensity). These objectives are intended to drive strong environmental performance, promote external transparency and accountability, and enhance internal alignment and employee innovation.

The following Climate Change subsection of our Sustainability Report is aligned with the Task Force on Climate-related Financial Disclosures (TCFD).

Governance

The board has ultimate responsibility for risk management, and their decision-making takes climate-related risks into account. In 2019, we added climate change risk oversight to the charter of the Health, Environmental, Safety and Corporate Responsibility (HES&CR) committee of the board of directors to highlight our commitment and how seriously we approach a robust understanding and evaluation of climate risk. This committee meets at least twice per year to understand and monitor climate-related trends, issues, legislation, policies, practices and concerns, including performance against our stated emissions reduction objectives.

Our executive vice president of Operations, who reports directly to the CEO, has leadership responsibility for climate-related issues and provides regular updates to the board regarding performance. Our vice president of Health, Environment, Safety, Security (HES&S) and Corporate Sustainability, who reports to the executive vice president of Operations, has leadership accountability for driving our corporate sustainability programs. This role provides the strategic focus necessary to align all areas of our corporate ESG strategy and embed sustainability practices into the way we run our business.

Strategy

We use the ERM process to identify and manage the most significant risks facing the company, with the goals of facilitating risk oversight by the board, managing enterprise risks and ensuring accountability for risk management. Internal risk assessors present ERM process outcomes related to climate risk to the HES&CR, and Audit and Finance committees to inform the board’s oversight responsibilities.

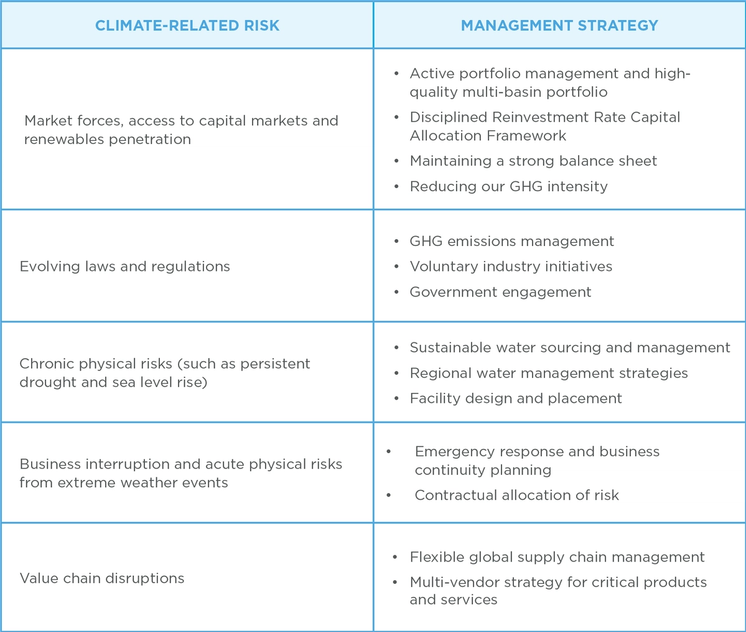

Through our ERM process, our board and management examine a wide range of strategic, reputational, operational and financial risks that could impact the company. The primary potential climate-related risks identified through the ERM process are:

- Market forces that could affect commodity prices, including renewables uptake and pace of energy transition.

- Access to capital markets.

- Evolving U.S. federal and state and global climate change policies, laws and regulations.

- Chronic physical risks (such as persistent drought and sea level rise).

- Business interruption and acute physical risks from extreme weather events.

- Value chain disruption.

We continue to evaluate and enhance our risk assessment processes to provide company leaders with the information they need to manage climate risk.

Our corporate HES&S group monitors a number of key environmental performance indicators. Operational leaders identify, assess and manage GHG emissions and other aspects of climate change risk using ROMS. The ROMS executive steering team and owners of relevant ROMS elements are then accountable for driving performance improvement, including managing climate change risk. For more information, see the Sustainability Management section.

Strategy to Mitigate Our Risks

We evaluate our business model by applying our risk assessment tools and measuring alignment with our governance models, and we monitor and take proactive steps to mitigate risks to our business strategy related to climate change.

We have operationalized key environmental performance indicators that are used to drive asset performance improvements. In addition, we monitor regulatory changes and risks through our trade organizations and government relations professionals, which allows us to adjust business plans and operations to mitigate risks.

Managing Our Business for Resilience to Market Forces

Resilience of our Capital Expenditure Program

We primarily allocate our capital expenditures to high-return, short-cycle, unconventional resource plays. Due to the production profile for the typical unconventional well, the commodity price during the first few years of production has a much greater effect on project economics than longer-dated commodity prices. Most of the wells we drill have short payback periods. This mitigates the longer-term commodity price risk related to our capital investment decisions (reduces stranded asset risk) and enhances our capital allocation flexibility and ability to respond to changes in the macro environment.

Our short-term planning horizon is two years, and our medium-term planning horizon is five years, consistent with both the short-cycle nature of our portfolio and Securities and Exchange Commission (SEC) rules governing proved reserve bookings. Our long-term planning horizon is 10 years.

We typically disclose a detailed annual plan and budget in the first quarter of every calendar year. In each of the last two years, we have augmented our annual plan with the disclosure of a Five-Year Benchmark Maintenance Scenario that holds oil production flat and maximizes our free cash flow generation – fully consistent with our corporate priorities and disciplined capital allocation framework. We also frequently assess our capital investment program and the robustness of our portfolio over our longer-term 10-year planning horizon.

The financial returns and competitiveness of our capital investment program are routinely stress-tested across these time horizons using conservative commodity price assumptions. Projects must meet specific financial targets and/or strategic objectives to be sanctioned.

Our Approach to Mitigating Market Risks

Marathon Oil’s corporate strategy is informed by our assessment of the competitive environment for energy and longer-term oil and gas fundamentals. We take proactive steps to mitigate risks and uncertainties associated with climate change and market forces, including the potential for lower future commodity prices and the potential for a future cost on carbon emissions. This includes actively managing and maintaining a high-quality multi-basin portfolio; sticking to a disciplined capital allocation framework; maintaining a strong balance sheet; and driving significant GHG emission reductions. All of which are included in our Framework for Success.

Active Portfolio Management and High-Quality Multi-Basin Portfolio

We’ve simplified and concentrated our portfolio to improve our competitive positioning. Over the last decade, we’ve divested higher-cost, higher-risk, lower-margin assets including: Canadian oil sands; Libya; the U.K. and Norway North Sea; Kurdistan; Wyoming; and conventional offshore exploration.

These divestments have lowered our enterprise and regulatory risk, enhanced our financial performance, improved our cost structure, reduced our corporate free cash flow breakeven and lowered our longer-term liabilities (including asset retirement obligations).

Our U.S. resource plays are complemented by our high-quality integrated gas business in Equatorial Guinea, which is highly cash flow generative with minimal sustaining CAPEX requirements. Our U.S.-focused unconventional portfolio has less execution risk in comparison to more globally diversified operations. Our low-cost, high-margin U.S. assets also contribute to our low enterprise breakeven, which mitigates our vulnerability to lower commodity prices.

Additionally, the short-cycle nature of our portfolio reduces our “stranded asset” risk and enhances our capital allocation flexibility and ability to respond to changes in the macro environment.

Our strategic decision to optimize our portfolio and primarily focus our capital investment on high-quality U.S. resource plays is affirmed by the International Energy Agency (IEA) and U.S. Energy Information Administration (EIA) long-term modeling assumptions that testify to the global cost competitiveness and expected resilience of U.S. tight oil production. Under the IEA’s latest Sustainable Development Scenario (a Paris Climate Agreement aligned framework), the global supply of tight oil (95% of which comes from the United States) is expected to increase by approximately 10% from 2020 to 2040 to help meet global energy demand. This is in stark contrast to an expected decline in total world oil supply of approximately 30% from 2020 to 2040. So even though global oil demand and global oil supply are expected to decline by 2040, the supply of tight oil (the overwhelming focus of Marathon Oil’s capital investment) must actually rise from current levels to help meet global demand.

We believe this is consistent with the advantaged cost structure, profitability and environmental profile of U.S. tight oil production, which is among the safest, most responsible and lowest GHG intensity sources of production globally.

Disciplined Capital Allocation Framework

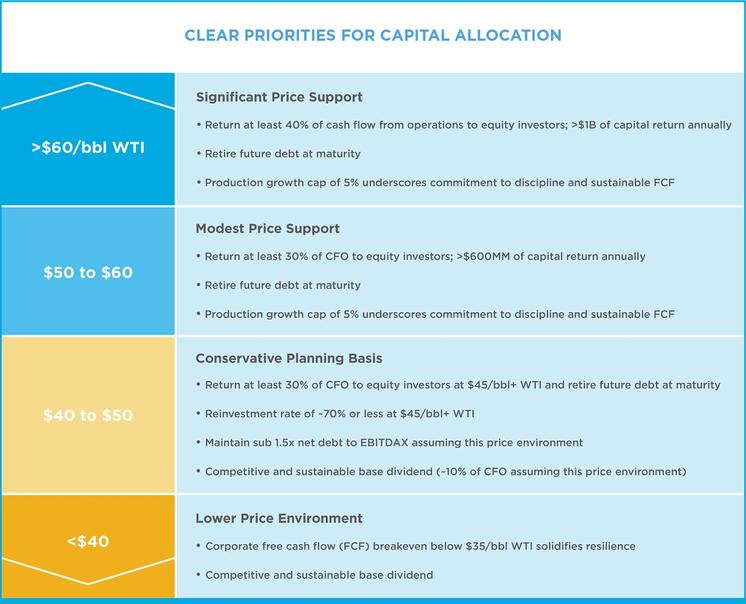

Marathon Oil’s disciplined reinvestment rate capital allocation framework prioritizes strong corporate returns, sustainable free cash flow generation and meaningful return of capital to investors. We believe this capital allocation framework is optimal for a cyclical commodity business and that it appropriately contemplates the longer-term risks and uncertainties associated with climate change and related market forces.

We closely monitor our reinvestment rate, corporate free cash flow breakeven, cash flow per share (all of which are core metrics within our short-term incentive compensation scorecard) and the portion of our cash flow from operations that we return to investors. We believe these are tangible metrics upon which investors concerned with longer-term market risk should be focused.

- Reinvestment Rate: Our reinvestment rate represents the ratio of expected capital spending to cash flow generation. Assuming an oil price of $45/bbl WTI or higher, we target a reinvestment rate of 70% or less of our cash flow from operations. Our reinvestment rate framework instills discipline and competition into our capital allocation framework, enhances our financial returns and protects our ability to generate free cash flow throughout the commodity price cycle. Investing with discipline further reduces the risk that we overcapitalize our business into a potentially more challenging market environment.

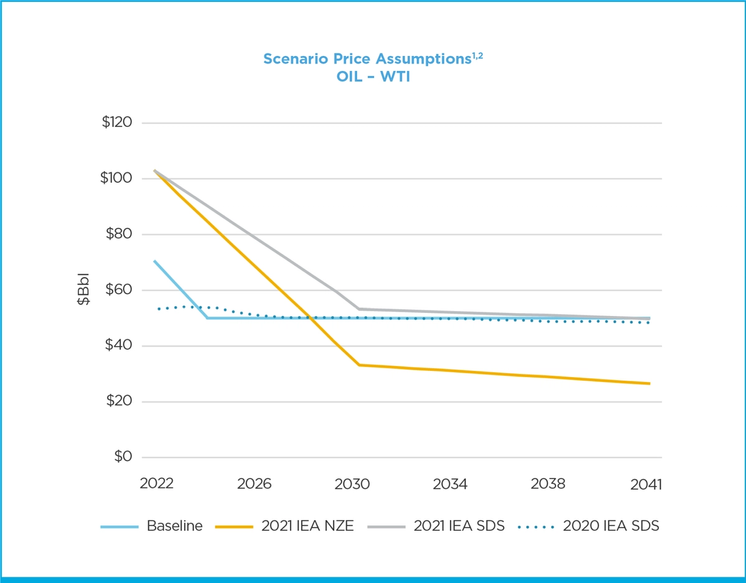

- Corporate Free Cash Flow Breakeven: Our corporate free cash flow breakeven represents the oil price necessary to generate cash flow from operations to cover our capital spending. For comparison, our 2021 sub $35/bbl WTI breakeven is below the IEA’s NZE 2030 oil price assumption of $36/bbl (real 2020 dollars). Through ongoing cost structure optimization, disciplined capital allocation and a relentless focus on our capital and operating efficiency, our objective is to maintain our low corporate breakeven and even drive it lower over time. Our focus is consistent with our objective to be the low-cost operator, better positioning us to manage through market environments that could be more challenging in the future.

- Growth in Cash Flow Per Debt Adjusted Share: Our focus is per share growth on the metrics that matter most to our investors.

Returning capital to investors is a critical strategic objective and our unique percent of cash flow from operations model prioritizes our shareholders. Above $60/bbl WTI, our goal is to return at least 40% of our cash flow from operations to our shareholders through the combination of dividends and share repurchases. We believe that significant return of capital helps mitigate longer-term risks for investors in our sector and promotes our company as a compelling investment within the broader market.

Maintaining a Strong Balance Sheet

Maintaining our strong balance sheet, as evidenced by our investment grade credit rating, is foundational to executing our strategy and enhancing our resilience to market forces. We have a demonstrated track record of conservative financial policy and we plan to maintain our balance sheet strength through our disciplined capital allocation framework and our conservative leverage targets, including a net debt to EBITDA objective of sub-1.5x assuming a $45/bbl to $50/bbl WTI oil price. A strong balance sheet will help us execute our strategy in a more challenging market environment.

Reducing our GHG Intensity

Driving significant and continuous reductions in our GHG emissions intensity is a core part of our strategy to mitigate the longer-term market risks related to climate change. Intensity metrics are more indicative of our underlying reduction initiatives by normalizing to production levels and provide for more direct comparisons across our peers independent of scale or changes to production levels. Our GHG reduction initiatives are supported by transparent, quantitative objectives intended to promote accountability and ingenuity throughout our organization.

Our target-setting efforts are focused on GHG and methane intensity. Further, our disciplined capital allocation framework puts limits on both our capital investment levels and our production growth outcomes. This will contribute to lower absolute emissions over time in comparison to more aggressive production growth initiatives that have historically characterized the E&P industry. For example, relative to our 2019 baseline, we have driven a 48% reduction in our total absolute GHG emissions, which exceeds the 38% reduction in our GHG intensity over the same timeframe.¹ Looking ahead to 2030, assuming a 10-year Maintenance Scenario that holds our production flat, achieving our long-term GHG intensity reduction goal would imply an absolute GHG emissions reduction of approximately 75% relative to our 2019 baseline.

The Role of Long-term Scenario Analysis

This report provides the results of an analysis of the potential impacts to our asset portfolio and business under different scenarios, including the IEA’s Sustainable Development Scenario and Net Zero Emissions by 2050 Scenario, none of which are intended to be predictions of what is likely to happen or what we believe is likely to happen. Instead, the scenarios are meant to examine the potential effects of several regulatory, economic and societal conditions that could occur — a scenario should not be confused with a solution. They do not provide a comprehensive description of all possible future outcomes and there can be no assurance that the scenario modeling and assessment presented in this report are reliable indicators of the actual impact of climate change, or efforts to address climate change, on Marathon Oil’s asset portfolio or business. The scenario models and assessments were based on our portfolio as of Dec. 31, 2021, and exclude any changes to laws, regulations or policies that occurred subsequent to Dec. 31, 2021. Moreover, the wide range of unpredictable variables and externalities affecting long-term outcomes makes long-term modeling of these scenarios inherently speculative.

Due to the short-cycle nature of our portfolio, our capital allocation flexibility and our limited risk for “stranded assets,” we believe scenario analysis beyond 10 years has limited usefulness for our company. IPIECA’s 2019 awareness briefing (The Role of Scenario Analysis in Climate Reporting) makes a similar point, pointing out the risks of scenario analysis for E&P companies. The briefing states that “companies are valued on proven reserves, which are usually monetized over a shorter horizon than, for example, the extent of the IEA Sustainable Development Scenario, thus indicating that the risk of ‘stranded assets’ is small and unlikely to be indicated by such a scenario.” Similarly, a simple analysis of our market equity valuation relative to our cash flow generation potential at prevailing commodity prices indicates we have limited long-term (10+ years) commodity risk, as the equity market appears to be assigning little to no value to potential cash flows beyond the next 10 years.

While we understand the limitations, we still believe longer-term scenario analysis can be a useful tool to inform our strategy, help us better understand how supply and demand dynamics and the market environment may evolve in the coming decades, test the robustness of our strategy and portfolio across different long-term environments and satisfy the interests of certain specialist investors.

We monitor longer-term forecasts and scenarios regarding the potential evolution of oil and gas supply and demand, commodity prices and the potential for a price on carbon. This includes third-party forecasts and scenarios from leading investment banks and energy forecasting agencies, including the EIA and IEA. However, we also recognize that we are price takers, not price predictors, with no ability to influence the selling price of the global commodities we produce. We believe we should therefore test our business model across a broad range of commodity prices while continuing to enhance our long-term resilience – by driving our enterprise free cash flow breakeven price as low as reasonably possible maintaining a balanced portfolio and protecting our investment grade balance sheet.

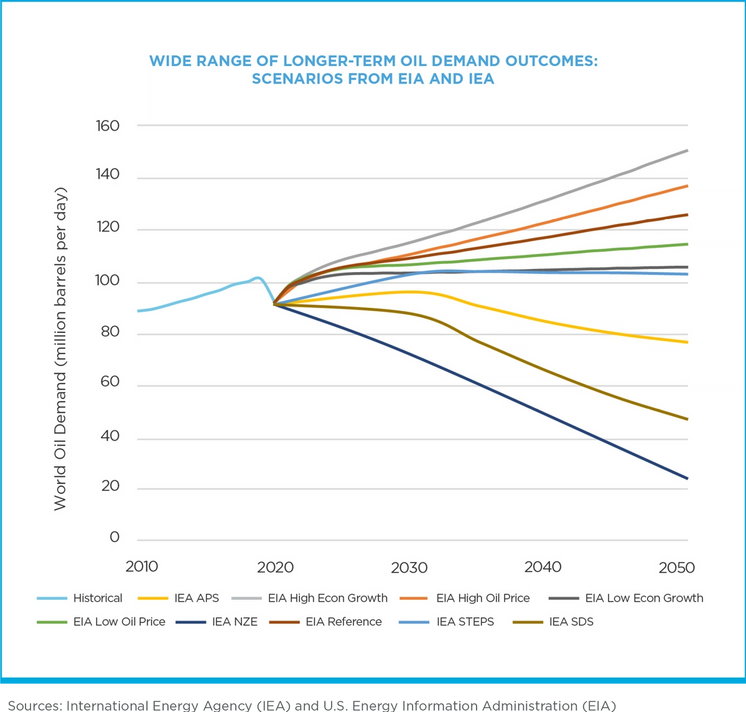

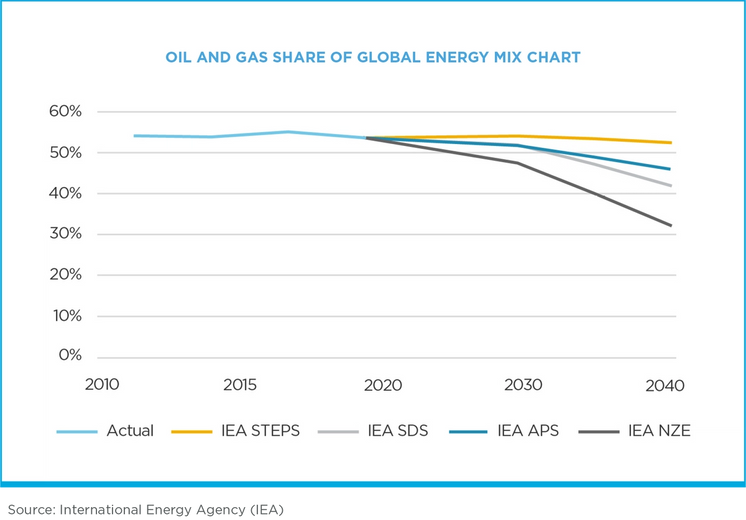

An analysis of forecasts and scenarios from the EIA and IEA, as shown below, highlights the wide range of potential outcomes for oil and gas supply and demand fundamentals and commodity prices over the coming decades.

Most forecasts and scenarios also indicate that oil and gas will continue to comprise a significant share of the global energy mix, including the scenarios most recently published by the IEA in its World Energy Outlook 2021. For example:

- In 2020, oil and gas accounted for 54% of global energy demand.

- By 2030, IEA scenarios indicate oil and gas could account for 48% to 54% of global energy demand.

- By 2040, IEA scenarios indicate oil and gas could account for 33% to 54% of global energy demand.

We recognize that oil and gas supply and demand fundamentals have proven difficult to predict – especially over multi-decade time horizons. Therefore, there is a wide range of potential long-term outcomes for market fundamentals. However, hydrocarbons are foundational to our modern society and way of life, billions of people continue to live in energy poverty and need access to reliable energy, and the global population continues to grow. Reliably and responsibly produced oil and gas should continue to comprise a significant share of the global energy mix through at least 2040. These conclusions are supportive of our current strategy and our belief that an elite group of E&P companies – positioned at the low end of the global cost curve and that operate responsibly – will be needed to provide the energy the world needs for continued global economic progress.

Reviewing IEA Long-term Scenarios

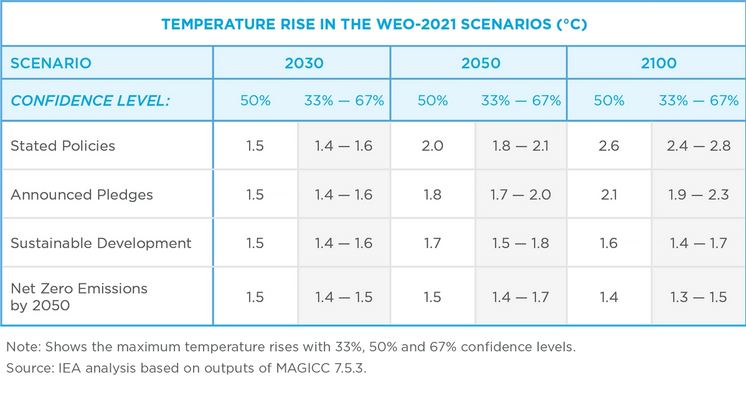

In conducting our long-term scenario analysis, we leveraged scenarios published by the IEA. The IEA’s World Energy Outlook 2021 includes four scenarios, which are summarized below.

- The Net Zero Emissions by 2050 Scenario (NZE) shows a narrow pathway for the global energy sector to achieve net zero CO2 emissions by 2050, with advanced economies reaching net zero emissions in advance of others. This scenario also meets key energy-related United Nations Sustainable Development Goals (SDGs), in particular achieving universal energy access by 2030. The NZE does not rely on emissions reductions from outside the energy sector to achieve its goals but assumes that nonenergy emissions will be reduced in the same proportion as energy emissions. It is consistent with limiting the global temperature rise to 1.5°C without a temperature overshoot (with a 50% probability). The NZE effectively back solves for a predetermined 2050 Net Zero outcome.

- The Sustainable Development Scenario (SDS) is a “well below 2°C” pathway and represents an approach to achieving the outcomes targeted by the Paris Agreement. The SDS assumes all energy-related SDGs are met, all current net zero pledges are achieved in full, and there are increased efforts to realize near-term emissions reductions; advanced economies reach net zero emissions by 2050, China around 2060 and all other countries by 2070 at the latest. Without assuming extensive net negative emissions, this scenario is consistent with limiting the global temperature rise to 1.65°C (with a 50% probability). With some level of net negative emissions after 2070, the temperature rise could be reduced to 1.5°C in 2100. The SDS effectively back solves for a predetermined “well below 2°C” pathway outcome.

- The Announced Pledge Scenario (APS) takes account of all the climate commitments made by governments around the world, including Nationally Determined Contributions as well as longer-term net zero targets, and assumes that they will be met in full and on time. The global trends in this scenario represent the cumulative extent of the world’s efforts to tackle climate change as of mid-2021. The remaining difference in global emissions between the APS and the goals in the NZE or the SDS shows the “ambition gap” that needs to be closed to achieve the goals agreed to in the Paris Agreement in 2015. The APS is not designed to achieve any particular outcome.

- The IEA Stated Policies Scenario (STEPS) does not take for granted that governments will reach all announced goals. Instead, the STEPS explores where the energy system might go without additional policy implementation. As with the APS, it is not designed to achieve a particular outcome. It takes a granular, sector-by-sector look at existing policies and measures and those under development. The remaining difference in global emissions between the STEPS and the APS represents the “implementation gap” that needs to be closed for countries to achieve their announced decarbonization targets.

We specifically focused on the IEA’s SDS and NZE, as both achieve all outcomes targeted by the Paris Climate Agreement and represent “well below 2°C” warming pathways, consistent with TCFD guidance to take into consideration “2°C or lower” scenarios.

Yet while the SDS and NZE may be appropriate for scenario analysis, neither is consistent with our base-case planning forecast as they represent unlikely longer-term outcomes. In particular, the NZE approach of back solving for the predetermined 2050 net-zero outcome results in less credible market and behavioral assumptions at odds with current trends, an unprecedented decoupling in the relationship between population growth, economic output and energy use, and the aggressive deployment of technologies that currently do not exist at scale. Approximately 50% of modeled emissions reductions in the NZE come from technologies that currently are in the demonstration or prototype phase. All of this underscores the fact that scenarios are not solutions and generally reflect broad-based assumptions that rely on many factors, including both policy changes and technical innovation.

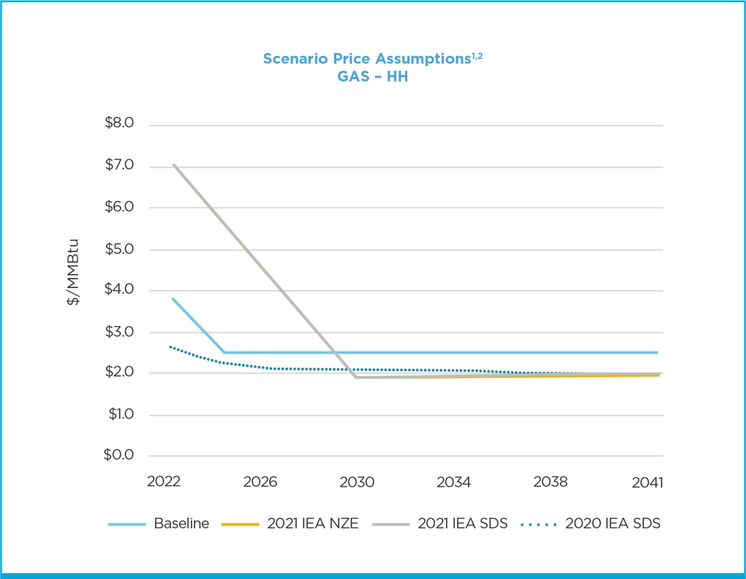

Scenario Analysis Methodology

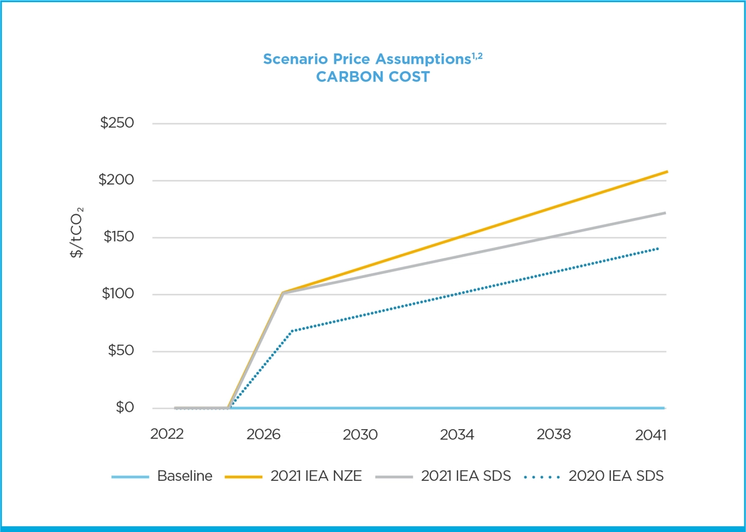

We first established a baseline portfolio value using a non-escalated commodity price deck of $50/bbl oil and $2.50/MMBtu natural gas. This price deck is conservative relative to both current and forward curve commodity prices and is consistent with how we routinely test the economic quality of our U.S. unconventional inventory and capital investments. We made no assumptions for a cost of carbon in our baseline assessment as there is currently no cost of carbon for U.S. producers. We believe using conservative commodity price assumptions while excluding a price of carbon, enables us to establish a transparent baseline portfolio value against which we can sensitize our portfolio to different market environments.

We then leveraged the aforementioned IEA SDS and NZE forecasts to generate scenarios that test the robustness of our portfolio in a carbon-constrained world. Specific SDS and NZE modeling assumptions and outputs are summarized below.

We assessed the impact to our net present value and economic resource base by comparing the results from the IEA scenarios to our baseline scenario. We also considered the potential impact to planned capital expenditures, remaining asset lives, as well as the potential impact to asset valuations (impairments) and future asset retirement obligations (AROs) as reflected in our financial statements for the year ended Dec. 31, 2021.

Key IEA SDS Assumptions:

- Global Oil and Gas Demand: From 2020 to 2030, global oil and gas demand increases by 2%. From 2020 to 2040, global oil and gas demand declines by 22%. The share of oil and gas in the global energy mix is 52% in 2030 and 42% in 2040 (compared to 54% in 2020).

- Commodity Prices: Crude oil prices average $56/bbl in 2030, declining to $53/bbl in 2040. U.S. natural gas prices average $1.90/MMBtu in 2030, slightly rising to $2.00/MMBtu in 2040 (real 2020 dollars).

- Carbon Price: price on carbon for advanced economies is assessed at $100/tonne by 2030, rising to $205/tonne in 2040 (real 2020 dollars).

Key IEA NZE Assumptions:

- Global Oil and Gas Demand: From 2020 to 2030, global oil and gas demand declines by 16%. From 2020 to 2040, global oil and gas demand declines by 47%. The share of oil and gas in the global energy mix is 48% in 2030 and 32% in 2040 (compared to 54% in 2020).

- Commodity Prices: Crude oil prices average $36/bbl in 2030, declining to $28/bbl in 2040. U.S. natural gas prices average $1.90/MMBtu in 2030, slightly rising to $2.00/MMBtu in 2040 (real 2020 dollars).

- Carbon Price: A price on carbon for advanced economies is assessed at $75/tonne by 2025, rising to $130/tonne by 2030 and $205/tonne by 2040.

Scenario Analysis Observations

Overall, long-term scenario analysis supports our belief that both our current strategy and portfolio are resilient to a more carbon-constrained future that achieves both United Nations Sustainable Development Goals and Paris Climate Agreement objectives. Should the NZE’s post-2030 business environment become a reality, we would take steps to aggressively reduce our costs, improve our efficiencies, capture deflation, and continue to optimize our portfolio - all of which could help us mitigate any potential negative impacts to our business, consistent with our track record during historic down-cycles. None of these potential economic enhancements are included in the scenario analysis.

- Net Present Value (NPV) Of Future Cash Flows: The NPV of our future cash flows is a useful metric as it is a proxy for the potential market valuation of our company. Neither the SDS nor the NZE is expected to have a negative impact to the NPV of future cash flows relative to our Baseline Scenario, as the positive impact of currently elevated commodity prices outweighs the impact of much lower commodity prices in 2030 and beyond. The application of a carbon cost that is consistent with the IEA’s SDS could have a modestly negative impact on our NPV of future cash flows - helping us to understand the materiality of any such future regulation.

- Economic Resource Base: Well below 2°C warming scenarios could modestly reduce our net economic resource base relative to our Baseline Scenario, largely due to lower assumed commodity prices beyond 2030 and the assumed carbon cost. The SDS could result in a reduction to our net economic resource base of less than ~10% while the NZE impact could be less than ~15%. However, under both the SDS and NZE, our underlying resource base remains sufficiently robust to deliver on our strategic objectives for the foreseeable future.

- Planned Capital Expenditures: The application of IEA NZE and/or SDS assumptions and outputs is unlikely to have any material impact to our planned capital expenditures through at least 2030. This is largely because our capital investment program is already conservative, consistent with our disciplined framework that prioritizes free cash flow generation over production growth. For 2022, we are executing a maintenance-level program that maximizes our free cash flow generation and has an enterprise free cash flow breakeven below $35/bbl WTI (at a conservative natural gas price below the current strip). Our sub $35/bbl WTI breakeven is below the IEA’s NZE 2030 oil price assumption of $36/bbl (real 2020 dollars), underscoring the resilience of our capital program and portfolio.

- Asset Valuations and Impairments: We screened our long-lived assets for potential impairments under both SDS and NZE Scenarios, recognizing neither scenario is consistent with our baseline planning forecast. Under the SDS, we believe asset impairments are unlikely. Under the NZE, our analysis indicates approximately 10% or less of our long-lived assets could potentially be subject to impairment, due to the decline in commodity prices beyond 2030 and the escalating carbon cost. We do not believe that this impairment risk would have any material impact on our ability to deliver on our strategic objectives.

- Asset Retirement Obligations and Estimated Useful Lives of Assets: Our asset retirement obligations (AROs) primarily relate to the abandonment of oil and gas producing facilities. We carried a $288 million ARO liability on our balance sheet as of Dec. 31, 2021, equivalent to approximately 2% of our net property, plant and equipment (PP&E) on our balance sheet as of Dec. 31, 2021. Notably our ARO balance is down considerably from the year-end 2016 balance of approximately $1.7 billion due to our success in portfolio optimization. Application of the IEA’s SDS assumptions and outputs are not expected to drive any material changes to our current ARO balance (including timing or composition thereof). The lower longer-term commodity prices in the IEA NZE could contribute to an acceleration in estimated retirement dates for certain assets. To estimate the potential impact of the IEA NZE on our ARO, we conducted a high-level sensitivity analysis and assumed the retirement date for all assets was reduced by 10 years. Under these assumptions, our current ARO liability of approximately 2% of net PP&E could potentially increase to approximately 3% of net PP&E.

Perspective on Scope 3 Emissions

Our GHG and methane intensity objectives are focused on our operated Scope 1 and 2 emissions – the emissions under our control. We believe driving significant reductions to our operated Scope 1 and 2 emissions is the right objective for our company and global consumers of energy.

While we have disclosed our estimated Scope 3 emissions within this report for the sake of transparency, we do not believe our estimated Scope 3 emissions data is material information for our shareholders and we believe the usefulness of Scope 3 data for individual company comparison or performance is compromised by a number of considerations, a few of which we highlight below:

- As an E&P, we do not manufacture products or sell directly to our consumers.

- Scope 3 includes emissions outside of our direct control that can be difficult if not impossible to reduce or even estimate accurately. The oil and natural gas that we produce have a variety of end uses which are ultimately determined by consumer behaviors and economic demand.

- Scope 3 emissions are subject to double (or more) counting across companies and industries.

- Scope 3 disclosure from one company to the next is often inconsistent, incomparable, misleading and therefore can be a poor indicator of a company’s relative climate risk.

- Scope 3 emissions at an individual company level do not provide a holistic view of carbon emissions and therefore provide an incomplete, if not misleading perception of a company’s relative impact on overall GHG emissions. For example, the increased consumption of U.S. natural gas to displace coal increased the Scope 3 emissions of many companies but simultaneously drove tremendous net reductions to GHG emissions in the U.S. electric sector.

- A primary focus on reducing Scope 3 emissions without consideration of global demand trends could have negative consequences for global consumers of energy, energy security and the environment. For example, a specific company-level focus on reduction of Scope 3 emissions notwithstanding end-user demand trends could result in a reduction of domestically produced oil and gas which could contribute to a shortage of U.S.-produced energy and elevated global oil and gas prices that reduce societal access to energy. Additionally, if U.S. produced oil and gas is displaced by other sources of global supply, there could be negative environmental consequences. Oil and gas produced in the U.S. is done so at the highest environmental and regulatory standards and with relatively lower GHG intensity when compared to other sources of global production. One could argue that growth in U.S. oil and gas production should be encouraged given its global top decile environmental footprint and should be the preferred supply source to meet global oil and gas demand, even though such growth could potentially increase Scope 3 emissions for the U.S. sector.

Managing Regulatory, Weather and Value Chain Risks

Our primary strategies for managing regulatory risk are applying technologies and techniques to reduce emissions; participating in voluntary industry initiatives to reduce emissions; monitoring proposed regulatory or legislative changes; and engaging in the regulatory and legislative process at all levels of government.

Although regulatory risks are uncertain, these developments could: set limits on emitted greenhouse gases; reduce the demand for crude oil, condensate, natural gas liquids and natural gas; increase costs to operate and maintain our facilities, limit future development opportunities, require installation of new emissions controls or participation in potential GHG or carbon trading or tax programs; and delay obtaining air pollution permits for our new or modified facilities. Marathon Oil monitors and prepares for regulatory changes that could impact our business and has implemented mitigation practices that help ensure resilience to a number of regulatory and legislative scenarios. These are discussed elsewhere in this report.

RISKS: Managing Weather-related Risks

Scientists have concluded that the increase in greenhouse gases in the earth’s atmosphere produces climate changes that can have significant effects. This includes chronic physical effects like frequent and severe droughts and higher sea levels, in addition to acute physical risks like increased frequency and severity of storms and floods. If any of these occur in our operating areas, we could experience safety or environmental impacts, downtime or damaged equipment, or other incidents at our sites. These risks are managed locally by our asset teams and our Centralized Emergency Response Team. Water Stewardship and Emergency Response are discussed elsewhere in this report.

RISKS: Managing Value Chain Risk

Our value chain is subject to some of the same climate-related risks as Marathon Oil, and we manage these largely through contractual risk allocation and other terms and conditions. We maintain a diverse set of critical suppliers and service providers to ensure that we maintain competitiveness and flexibility. We constantly evaluate ways to be more efficient and nimbler in managing our value chain, including through business interruption planning and vertical integration such as self-sourcing specific goods and services.

How are we doing?

Your opinion matters. Please take a moment to let us know how useful you find the content on this page.

If you’d like to give us your feedback on the entire report, please fill out the complete survey for the 2021 report.